Overview

- Administered by the CDFI Fund at the US Treasury Department

- CDFI Awards tax credits to Community Development Entities (CDEs)

- CDEs allocate tax credits to specific Projects in Low Income Communities

- Real Estate or Operating Business Investment – (Non-residential)

- 39% Federal Income Tax Credit

- Sell the Tax Credits to create subsidy for the Qualified Active Low Income Community Business “QALICB” – aka the Project

- After fees, net benefit =~ 20% of allocation amount

- 7 year compliance period

What is a Community Development Entity (CDE)?

- CDEs come in a variety of forms:

- An affiliate of a municipality to promote economic development

- An affiliate of a bank to help meet the bank’s community reinvestment goal

- Non-profit and for-profit entities with a mission to serve low income communities

- CDEs have defined geographic service areas and are charged with evaluating each potential NMTC transaction for community impact

- CDEs can be found using a search engine on the CDFI Fund website at www.cdfifund.gov

What is a Low Income Community?

- Based on census tract data – median income and/or poverty rate

- Qualifying vs. “Higher Distress” Includes unemployment, rural areas, Brownfield areas, designated Hot Zones, medically underserved areas, food deserts, Colonias and HUB Zones

- Qualifying census tracts in non-metropolitan counties automatically qualify as “higher distress”

- Qualifying census tracts can be located using the mapping program provided located on the CDFI Fund website at www.cdfifund.gov

Structure:

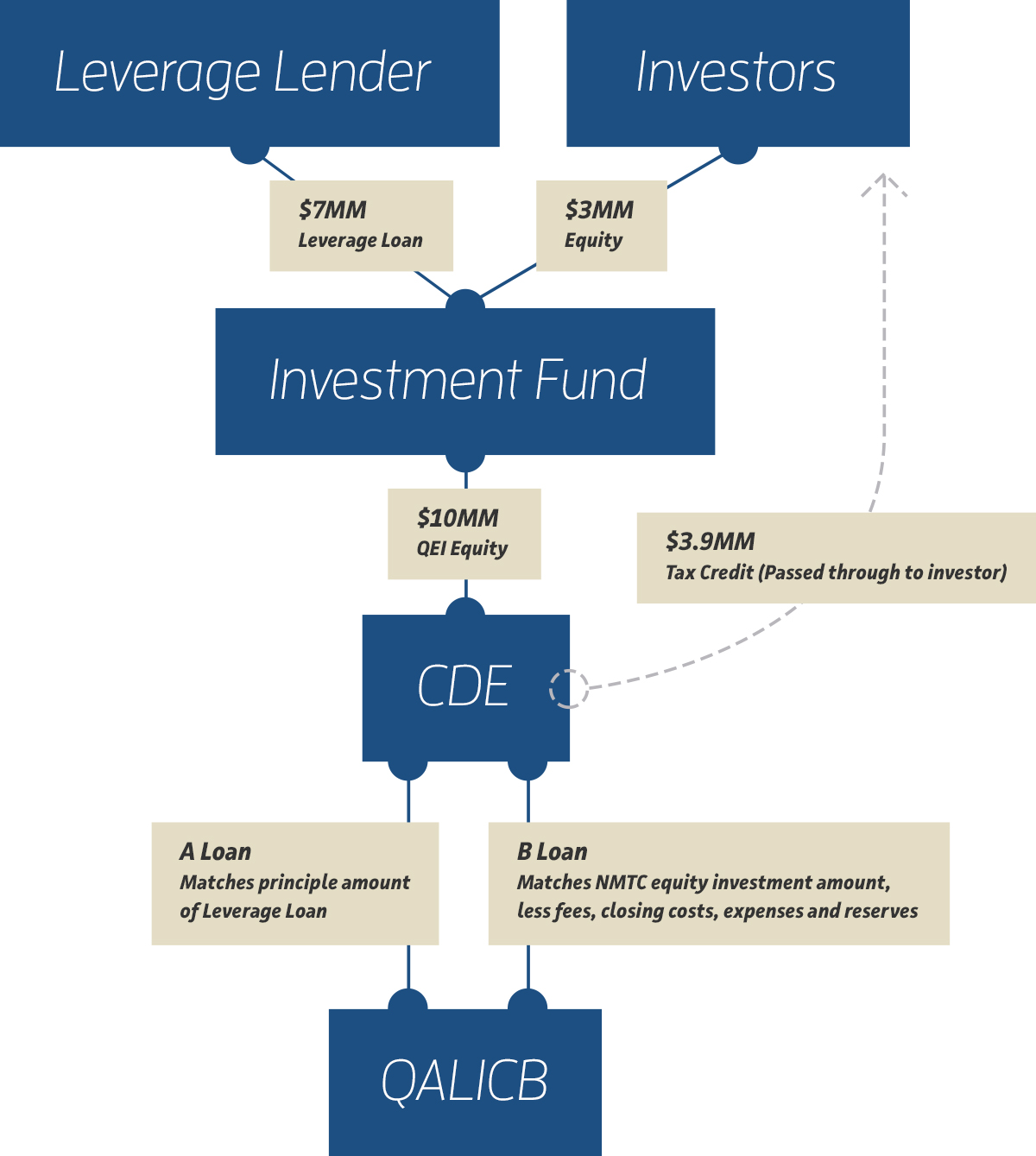

- An Investor buys the 39% tax credits for $.85 per dollar and makes an equity contribution to the project for that amount.

- Need a private source of funds to “leverage” the Tax Credit and provide the balance of funds.

- Together the Leverage lender & the Tax Credit equity flow to the project by way of the CDE.

Timing

Steps to Securing Allocation

Securing NMTC allocation for a Project is a competitive process. It starts with identifying CDE’s with a mission and a geographic focus that aligns with your Project. CDE’s then evaluate Projects based on the following:

- Eligibility – Is it located in a highly-distressed census tract?

- Certainty of Closing – Can this project close in a reasonable amount of time? Is it ready?

- Strong Sponsorship – Does the development team have the capacity to execute and the financial pieces in place? Does the project provide strong returns?

- Community Impact – Will this project have a meaningful impact on low income communities and low income residents?

- Job Creation

- Food production, health resources, education, innovation, Charter Schools, etc…

- “But For” – Could this project move forward without NMTCs?

If the above requirements are met, the CDE will issue a term sheet and the Project moves into the financial closing process.